Ask the professionals- Mar 7

Ask the professionals

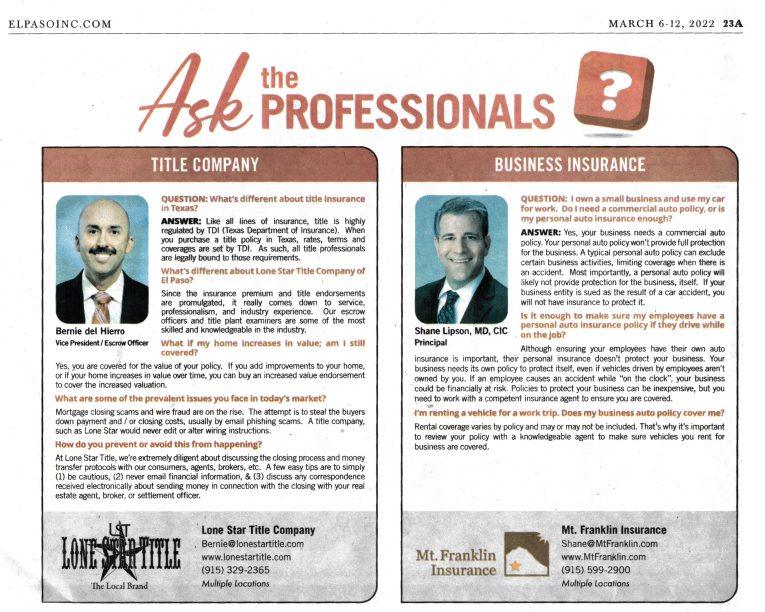

Bernie del Hierro

Vice President / Escrow Officer

Lone Star Title

Question: What’s different about title insurance in Texas?

Like all lines of insurance, title insurance is highly regulated by TDI (Texas Department of Insurance). When you purchase a title policy in Texas, rates, terms and coverage are set by TDI. As such, all title professionals are legally bound to those requirements.

What’s different about Lone Star Title Company of El Paso?

Since the insurance premium and title endorsements are promulgated, it really comes down to service, professionalism, and industry experience. Our escrow officers and title plant examiners are some of the most skilled and knowledgeable in the industry.

What if my home increase in value; am I still covered?

Yes, you are covered for the value of your policy. If you add improvements to your home, or if your home increases in value over time, you can buy an increased value endorsement to cover the increased valuation.

What are some of the prevalent issues you face in today’s market?

Mortgage closing scams and wire fraud are on the rise. The attempt is to steal the buyers down payments and/or closing costs, usually by email phishing scams. A title company, such as Lone Star would never edit or alter wiring instructions.

How do you prevent or avoid this from happening?

At Lone Star Title, we’re extremely diligent about discussing the closing process and money transfer protocols with our consumers, agents, brokers, etc. A few easy tips are to simply (1) be cautions, (2) never email financial information, & (3) discuss any correspondence received electronically about sending money in connection with the closing with your real estate agent, broker, or settlement officer.

Shane Lipson

Principal

Mt. Franklin Insurance

Question: I own a small business and use my car for work. Do I need a commercial auto policy, or is my personal auto insurance enough?

Yes, your business needs a commercial auto policy. Your personal auto policy won’t provide full protection for the business. A typical personal auto policy can exclude certain business activities, limiting coverage when there is an accident. Most importantly, a personal auto policy will likely not provide protection for the business, itself. If your business entity is sued as the result of a car accident, you will not have insurance to protect it.

Is it enough to make sure my employees have a personal auto insurance policy if they drive while on the job?

Although ensuring your employees have their own auto insurance is important, their personal insurance doesn’t protect your business. Your business needs its own policy to protect itself, even if vehicles driven by employees aren’t owned by you. If an employee causes an accident while “on the clock”, your business could be financially at risk. Policies to protect your business can be inexpensive, but you need to work with a competent insurance agent to ensure you are covered.

I’m renting a vehicle for a work trip. Does my business auto policy cover me?

Rental coverage varies by policy and may not be included. That’s why it’s important to review your policy with a knowledgeable agent to make sure vehicles your rent for business are covered.

Jimmy Garza

Owner

Jimmy Garza Emergency Water Removal

Question: Who should I hire when my home Orr business has water damage?

Hiring a company that specializes in water removal and drying services. Consequences of NOT hiring a company that specializes in water removal and drying services. With any kind of moisture, you can have secondary damages and mold. Mold can develop as fast as 24 to 72 hours (1-3 days).

Key to preventing secondary damages or mold within the home is hiring a water mitigation company to assess or complete a moisture inspection. First step is to remove the water within the home, then insure proper clean up techniques, and apply proper structural drying techniques. This will assist to speed up the drying process thus preventing the chances of further secondary damages and mold in your home.

As many contractor you choose to hire. Contractor should always give a written price estimate with a written scope of work before commencing any work on the property. This prevents any type of misunderstanding and holds the contractor liable. This also prevents fraud from contractor. It is suggested hiring a company that provides “Emergency Services” during regular and after hours. The word “mitigation” means to prevent.

Mitigation company with the right qualifications, experience, and capabilities can help prevent & save thousands in costs for mold, clean up and removal. Hiring an IICRC Certified Firm assures the company has thee correct qualifications, credentials (such as insurance) to provide such services within industry guidelines and IICRS standards.

Thomas B. Goldfarb

Financial Advisor

Goldfarb Financial

Question: We recently had aa long time client ask if there is a way to protect their business if one or more of their key employees suffered an unforeseen death or disability?

Yes…

Key person insurance provides a financial cushion if the unforeseen and sudden loss of a key person would significantly negatively affect the company’s operations.

In small companies in particular, the key person could also be the owner or founder of the company.

Key person insurance can be provided in the form of a life or disability insurance policy. In the case of a life insurance policy, the employer/company purchases, pays for, and is named the beneficiary of a policy on the life of the key person.

Should the key person die the payout of the life insurance policy essentially buys the company time to cover costs of recruiting, hiring and training a replacement for the deceased person. If the company decides it might be better to close the business the life insurance proceeds can also be used to play off debts, provide severance benefits to its employees, distribute moneys to other owners, and/or allow the business the opportunity two close the business down in a orderly manner.

In the case of a key person disability insurance situation, if the key person becomes disabled due to an accident or illness that doesn’t allow the person to work, then the policy’s payout will help thee business keep up with its expenses while allowing it to recruit, hire and train another person.