Ask the professionals

Ask the professionals

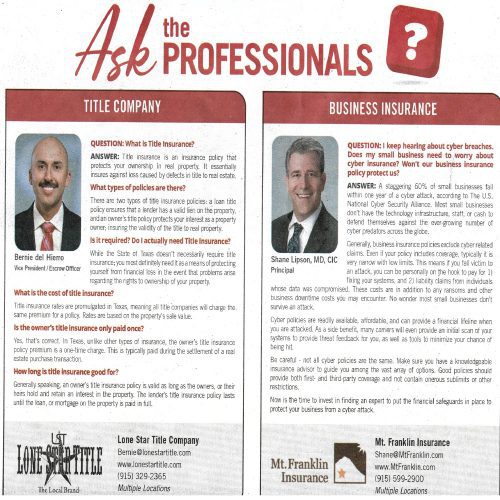

Bernie del Hierro

Vice President / Escrow Officer

Lone Star Title

Question: What is the Title Insurance?

Title insurance is an insurance policy that protects your ownership in real property. It essentially insures against loss caused by defects in title to real estate.

What types of policies are there?

There are two types of title insurance policies; a loan title policy ensures that a lender has a valid lien on the property, and an owner’s title policy protects your interest as a property owner;

insuring the validity of the title to real property.

Is ir required? Do I actually need Title Insurance?

While the State of Texas doesn’t necessarily require title insurance; your most definitely need it as a means of protecting yourself from financial loss in the event that problems arise regarding

the rights to ownership of your property.

What is the cost of title insurance?

Title insurance rates are promulgated in Texas, meaning all title companies will charge thee same premium for a policy. Rates are based on the property’s sale value.

Is the owner’s title insurance only paid once?

Yes, that’s correct. In Texas, unlike other types of insurance, the owner’s title insurance policy premium is a one-time charge.

This is typically paid during the settlement of a real estate purchase transaction.

How long is title insurance good for?

Generally speaking, an owner’s title insurance policy is valid as long as the owners, or their heirs hold and retain an interest in the property.

The lender’s title insurance policy lasts until the loan, or mortgage on the property is paid in full.

Shane Lipson

Principal

Mt. Franklin Insurance

Question: I keep hearing about cyber breaches.

Does my small business need to worry about cyber insurance?

Won’t our business insurance policy protect us?

A staggering 60% of small businesses fail within one year of cyber attack, according to The U.S National Cyber Security Alliance.

Most small businesses don’t have the technology infrastructure, staff, or cash too defend themselves against the ever-growing number of cyber predators across the globe.

Generally, business insurance policies exclude cyber related claims. Even if your policy includes coverage, typically it is very narrow with low limits.

This means if you fall victim to an attack, you can be personally on the hook to pay for

1) fixing your systems, and 2) liability claims from individuals whose data was compromised. These costs are in addition too any ransoms and other business downtime

costs you may encounter. No wonder most small business don’t survive an attack.

Cyber policies arre readily available, affordable, and can provide a financial lifeline when you are attacked. As a side benefit, many carries will even provide an initial

scan of your systems too provide threat feedback for your, as well to minimize your chance of being hit.

Be careful – not all cyber policies are the same. Make sure you have a knowledgeable insurance advisor to guide you among the vast

array of options. Good policies should provide both first- and third party coverage and not contain onerous sublimits or other restrictions.

Now is the time to invest in finding an expert to put the financial safeguards in place to protect your business from cyber attack.

Jimmy Garza

Owner

Jimmy Garza Emergency Water Removal

Question: How quickly can a water damaged home develop a serious mold problem?

With any kind of moisture situation, mold can develop as fast as 24 to 72 hours (1 – 3 days). When mold develops in a property,

it can often require a very costly clean- up and removal.

What promotes mold growth?

Mold requires water, food, and oxygen to grow. It also requires the right environment with a temperature it can survive.

While mold cannot spread without these conditions, it’s spores may survive in a dormant state until conditions are suitable.

- Temperature: Mold cannot grow below 40 º Fahrenheit. Mold grows

best between 77º F and 86º F, especially if there is an excess of humidity in the air. - Water: Mold thrives in damp, humid, and wet conditions. Mold

requires water to grow and spread, which is why it is recommended to keep homes-especially walls and carpets – as dry as possible.

Water leaks, flooding, high humidity, and condensation all provide moisture mold can use to grow and spread. - Oxygen: Mold needs oxygen to survive.

Key to preventing water damage or mold within the home is hiring a water mitigation company to assess the damages caused

by water intrusion.

First step is to remove the water within the home, then insure proper clean up techniques, and apply proper structural

drying techniques.

This will assist to speed up the drying process thus preventing the chances of further secondary damages and mold in your home.

Thomas B. Goldfarb

Financial Advisor

Goldfarb Financial

Question:

Our firm has a client who is part owner in three different businesses.

One of the businesses employs more than 50 full time employees.

The Affordable Care Act (ACA) requires that business offer its employees an affordable health insurance plan, which it does.

His other two companies are much smaller, and collectively employ approximately 20 employees between them.

He questioned if he was required by the ACA to offer health insurance to the employees of thee smaller companies?

The answer depended on his percentage of ownership in the entitles. He owns approximately 40% of the large entity,

while his siblings own smaller percentages, however her owns 100% of the smaller ones.

Control Group definitions are what apply to this question, as we understand the ACA. The ACA does not appear to

include sibling ownership as part of controlled groups, therefore it seems that our client is not required by law to

offer (and mostly pay for) a health insurance plan for the employees of the smaller companies.

The ACA is a very complicated piece of legislation and, while we are not attorneys, we have a lot of knowledge and

experience in dealing with these types of questions for employee benefit plans, so our clients remain compliant with

the ever-changing compliance landscape.